Selepas daftar income tax barulah kita boleh declare income tax. A b c.

Caranya dengan membuat e-filing.

. Included car house travel ticket accommodation ground tour food drinks. For examples commission and bonus. Download a copy of the form and fill in your details.

Dont forget to check out our Guide to Tax Clearance in Malaysia to learn who is it for and FAQs on CP 212222a58. Click on Permohonan or Application depending on your chosen language. Insentif dalam bentuk bukan wang tunai adalah seperti produk syarikat kereta dan rumah.

CP38 is an additional tax deduction issued by LHDN. Hak Cipta Terpelihara 2022 Lembaga Hasil Dalam Negeri Malaysia. Tax Clearance Form for Cessation of Employment of Private Sector Employees.

Pasport dan sijil pendaftaran perniagaan bagi bukan warganegara Malaysia yang menjalankan perniagaan. As explained in Public Ruling No. Get the LHDN form you need from the list below.

This form can be downloaded and submitted to Lembaga Hasil Dalam Negeri Malaysia. NOTA PANDUAN PENGISIAN BORANG CP58. Bulan Tahun.

Section 4a Business Income3. Employers are required to make additional monthly deduction on their employees salaries in the form of instalments. What it is all about.

12017 Tarikh Date. Currently every company is required to furnish a Statement of Monetary and Non-monetary Incentive Payment to an Agent Dealer or Distributor Form CP58 to the agent dealer or distributor who receives payment both monetary and non-monetary from the company arising from sales transactions or schemes carried out by him as an agent dealer or distributor each. I am Malaysia working and file income tax return in Singapore.

Insentif dalam bentuk wang tunai adalah komisen dan bonus. During declare income tax can i deduct my expense for agent job like online advertising fee all with proper receipt and invoices. Cash reward paid to agents distributors or dealers.

This is with the exception of those who carry out partnership businesses in Malaysia. More income tax coming your way. Statement of Incentive Payment.

Form CP 21 Leaving the country. Under the newly introduced WHT provision of Section 107D of the Income Tax Act 1967 effective from 1 January 2022 payments made by companies in monetary form to their authorised ADDs arising from sales transactions or schemes carried out by them are subjected to 2 WHT. 62011 bertarikh 16 Mei 2011.

But my side income company got issue me the CP58 form so i wonder i can deduct my expense before delcare income tax or not since the Cost take almost 50 of my gross income from side job. The payer company is responsible for obtaining the income tax number of. Statement of Monetary and Non-Monetory Incentive Payment to An Agent Dealer or Distributor Pursuant to Section 83A of the Income Tax Act 1967.

另外 我也有收到另间公司的CP58 第一次发生不同公司的income tax company number 我是要合在一起报在 总收入 还是 怎样呢. CP58 has 2 categories. Section 83A 1 of the Income Tax Act 1967 says that companies have the responsibility to issue and prepare form CP58 on any type of monetary incentive or non-monetary incentive payment to their agents distributors or dealers.

To assist in tax clearance for your employee we are providing these forms for easy download. The amended Form CP58 will include section to report the WHT deducted. MyTax - Gerbang Informasi Percukaian.

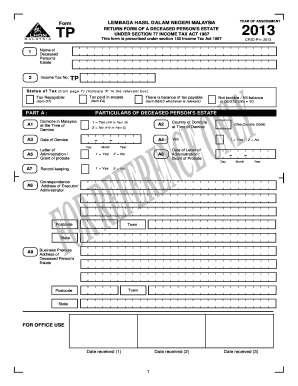

This form is prescribed under section 152 of the Income Tax Act 1967 BAHAGIAN B PART B. Borang CP58 Individu yang menerima komisen contohnya ejen-ejen penapis air MLM Takaful Unit Trust Remisier. As announced in the 2012 Malaysian Budget the proposed new Section 83A of the Income Tax Act 1967 requires every company making payments monetary or otherwise to its insurance and takaful agents to complete a prescribed form Form CP58 2011 which contains particulars of payments and provide it to the agents by.

Mastautin di Malaysia Resident in Malaysia a Individu Individual Seperti yang diterangkan di dalam Ketetapan Umum No. This is based on the Tax Deduction Chart issued by the Internal Revenue Board of Malaysia IRBM. Notice of Appeal to The Special Commissioners of Income Tax under Section.

Penyata bayaran insentif berbentuk wang tunai dan bukan wang tunai kepada Ejen Pengedar atau Pengagih Seksyen 83 Akta Cukai Pendapatan 1967. The retrospective effect of the law has caused difficulties to many companies as their information systems may not have such information in the year 2011. Announcement on CP58 The CP58 is a statement of monetary and non-monetary incentive payment to an agent dealer or distributor pursuant to Section 83A of the Income Tax Act 1967.

FORM CP58 Description Form Type Notes. They will be subject to tax for any foreign-sourced income received in Malaysia effective from 1 January 2022. In 2018 I started to have rental.

这一次我要跟大家说在大马报税 - Income Tax Cukai Pendapatan. The tax deduction is calculated based on the employees monthly taxable income. Mastautin di Malaysia Resident in Malaysia 1.

Statement of Monetary and Non-Monetory Incentive Payment to An Agent Dealer or Distributor Pursuant to Section 83A of the Income Tax Act 1967. 62011 dated 16 May 2011. Go back to the previous page and click on Next.

It is a statement of monetary non-monetary incentive payment to an agent dealer or distributor pursuant to Section 83A of the Income Tax Act 1967. Deduction of expenses Capital allowance4. This declaration must be made by a designated officer of the company pursuant to the Income Tax Act 1967 RM Day Month Year Hari CP58 Pin.

Click on e-Filing PIN Number Application on the left and then click on Form CP55D. With this affected individuals can continue to enjoy the exemption from 1 January 2022 to 31 December 2026.

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Cp58 Form 2021 Fill Online Printable Fillable Blank Pdffiller

.png)

What Is Form Cp58 And Do You Need To Prepare It

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

What Is Cp58 Sql Account Payroll Best Payroll Software Malaysia

Company Malaysian Taxation 101

Form Cp 58 Duty To Furnish Particulars Of Payment Made To An Agent Dealer Or Distributor Etc Malaysian Taxation 101

Everything You Need To Know About Cp58 Form Sst Invoice By Storyline Issuu

Doterra Business Malaysia Action Required Form Cp58 Year 2018 For Income Tax Return Filing To Inland Revenue Board Irb Of Malaysia Facebook

Ktp 𝐇𝐚𝐯𝐞 𝐲𝐨𝐮 𝐂𝐏 𝟓𝟖 Everyone Know Form Ea For Sure Facebook

Ktp 𝐇𝐚𝐯𝐞 𝐲𝐨𝐮 𝐂𝐏 𝟓𝟖 Everyone Know Form Ea For Sure Facebook

Ktp 𝐇𝐚𝐯𝐞 𝐲𝐨𝐮 𝐂𝐏 𝟓𝟖 Everyone Know Form Ea For Sure Facebook

Our Cp58 Form For Tax Declaration Live Well With Shaklee Facebook